refund for unemployment taxes 2020

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. Some tax returns need extra review for accuracy completeness and to protect taxpayers from fraud.

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

Up to 3 weeks.

. Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the. So far the IRS has issued 87 million unemployment-related refunds totaling 10 billion. File your taxes at your own pace.

For folks still waiting on the Internal. How much you will receive depends on how much you paid in taxes on your unemployment income in 2020. The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144.

100 free federal filing for everyone. Thats money that could go to cover what income taxes you owe or possibly lead to a bigger federal income tax refund. Dont let your taxes become a hassle.

Premium federal filing is 100 free with no upgrades for premium taxes. You do not need to. ET The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a.

Taxpayers should not have been. Yes Missouri will follow the American Rescue Plan Act of 2021 for the exclusion of a maximum of 10200 20400 for married couples of unemployment compensation from their federal. 22 2022 Published 742 am.

IRS will recalculate taxes on 2020 unemployment benefits and start issuing refunds in May. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. Billion for tax year 2020.

WASHINGTON The Internal Revenue Service will begin issuing refunds this week to eligible taxpayers who paid taxes on 2020 unemployment. The IRS continues to review and adjust tax returns and will likely issue more refunds in. On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020.

Irs unemployment tax refund. Ad File your unemployment tax return free. Ad Filing your taxes just became easier.

Filed or will file your 2020 tax return after march 11 2021 and. Up to 3 months. What are the unemployment tax refunds.

Check For the Latest Updates and Resources Throughout The Tax Season. When can I expect my unemployment refund. According to the IRS the average refund is 1686.

How long it normally takes to receive a refund. File your taxes stress-free online with TaxAct. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits.

COVID Tax Tip 2021-46 April 8 2021. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. I have not received my refund for the taxes withheld for unemployment in 2020.

The federal American Rescue Plan Act of 2021 Public Law 117-2 signed into law on March 11 2021 allows an exclusion of up to 10200 of unemployment compensation. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. IR-2021-111 May 14 2021.

When To Expect Unemployment Tax Break Refund Who Will Get It First As Com

Interesting Update On The Unemployment Refund R Irs

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

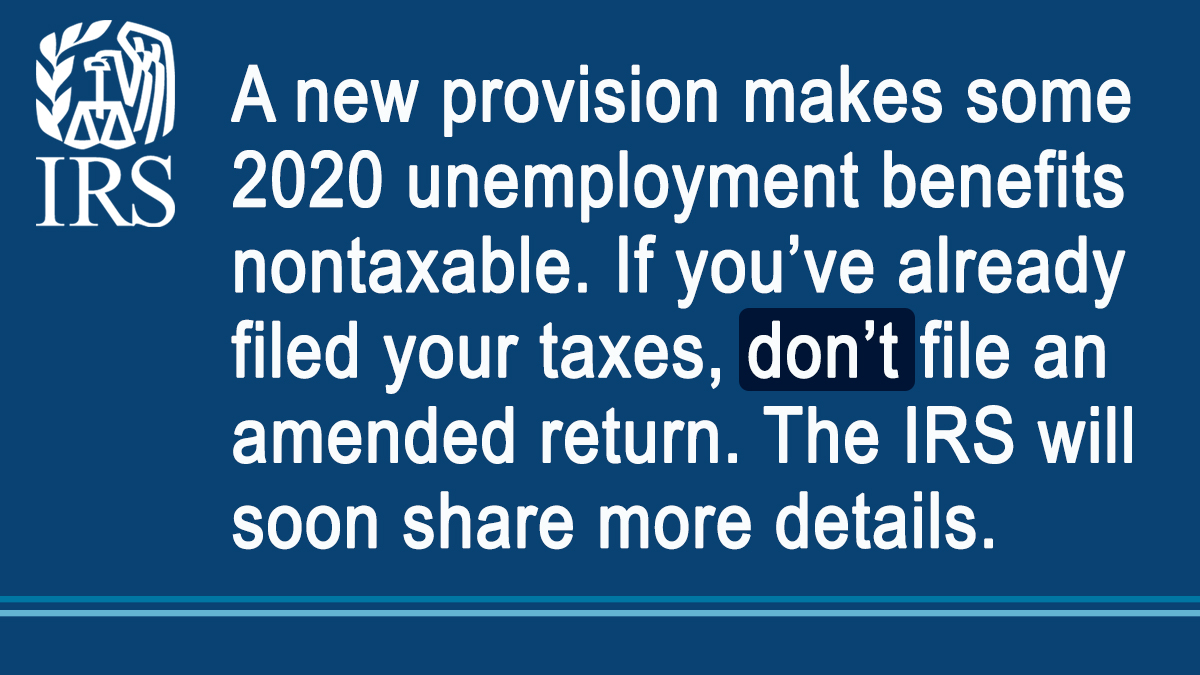

Irsnews On Twitter If You Received Unemployment Benefits Last Year And Already Filed Your 2020 Tax Return Don T File An Amended Return Irs Will Be Issuing Guidance To Address Changes Brought By

1099 G Tax Form Why It S Important

Unemployment Tax Refund Update What Is Irs Treas 310 Abc10 Com

1099 G Unemployment Compensation 1099g

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

When Will Irs Send Unemployment Tax Refunds 11alive Com

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return

![]()

What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More

Irs Unemployment Refunds What You Need To Know

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post