colorado electric vehicle tax incentive

As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits. Colorados tax credits for EV purchases The state offers tax incentives on new purchases of electric and plug-in hybrid vehicles.

Are Michigan S Registration Fees On Electric Vehicles Causing It To Fall Behind Other States

New EV and PHEV buyers can claim a 5000 credit on their income tax return.

. Ad Learn More about the All Electric 2022 Chevrolet Bolt EUV on the Official Chevy Site. Small neighborhood electric vehicles do not qualify for this credit but. Drive Electric Colorado and its affiliates are not tax advisors.

Tax credits for conversations are available until January 1 2022. There is also a federal tax credit available up to 7500 depending on the cars battery capacity. Colorado offers nice incentives for EV owners through its Income 69 program.

HB 13-1247 restructured the method for determining electric vehicle tax credits in Colorado but it also extended these credits through the year. 2500 for a new EV or 1500 for a 2 year lease. The time to go electric is now with Nissans Award-Winning Electric Car Lineup.

Trucks are eligible for a higher incentive. Ad 10000 Cars Trucks SUVs - Priced from 8k to 30k - 2 Minute Online Approval. Some dealers offer this at point of sale.

The credits decrease every few years from 2500 during January 2021 2023 to 2000. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022.

For additional information consult a dealership or this Legislative Council Staff Issue Brief. New EVs PHEVs. Compare Specs Of Hyundais Alt-Fuel Vehicles Like The IONIQ 5 NEXO Fuel Cell More.

3500 to buy or 1750 to lease. Electric Vehicle EV Tax Credit Qualified EVs titled and registered in Colorado are eligible for a tax credit. Explore Our Alt-Fuel Models Find Yours Today.

November 17 2020 by electricridecolorado. While Colorado does not have an electric vehicle rebate the state offers tax credits for the purchase or lease of an electric vehicle EV of up to 3500. Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled vehicles electricEV plug-in hybrid or PHEV compressed natural or CNG liquefied natural gas or LNG liquefied petroleum gas or LPG and hydrogen These credits were simplified effective Jan.

The table below outlines the tax credits for qualifying vehicles. The credits which began phasing out in. State Incentives Colorados National Electric Vehicle Infrastructure NEVI Planning added 6142022 Electric Vehicle EV Tax Credit Alternative Fuel Vehicle AFV Tax Credit Fuel Reduction Technology Tax Credit Alternative Fuel Vehicles and Infrastructure Grant Program Direct Current Fast Charging DCFC Plazas Program.

Get more power than ever with Nissan Electric Vehicles. Learn about the variety of electric vehicle models and the discounts you can take advantage of from trusted dealerships around Colorado on our EV Deals page. Light-duty EVs regular EV cars.

You might qualify for tax credits offered by the IRS if you purchase. Email the Technical Response Service or call 800-254-6735. For 2022 the amount of the tax credit to buy or lease an EV is.

Electric Vehicle EV Tax Credit Qualified EVs titled and registered in Colorado are eligible for a tax credit. Up to 7500 in federal tax credit. Dubbed Innovative Motor Vehicle and Truck Credits for Electric and Plug-in Hybrid Electric Vehicles the program provides fully refundable tax credits for qualified vehicles purchased from January 1 2021 to January 1 2026.

How much can I save with the Colorado electric vehicle incentive. Free Vehicle History Reports - 5 Day Return - Limited 30 Day Warranty - Bad Credit Loans. Tax credits for conversations are available until January 1 2022.

Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year. In addition to the Colorado-specific incentives offered by the State there are a number of federal tax credits for fuel-efficient vehicle owners.

Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year. CO State Tax Credit. DENVER - General Motors GM has informed state officials that the auto company will begin using Colorados assignability provisions of the Colorado Innovative Motor Vehicle Tax Credit effective immediately.

Ad The future of driving is electric. Colorado Tax Credits. Plenty of Space and Good Looks Explore the 2022 Chevrolet Bolt EUV.

5500 for income qualified customers. Get information about state and federal Tax Credits and learn about how to apply these credits toward your future EV. The credit amount will vary based on the capacity of the battery used to power the vehicle.

Want to switch to an EV. Qualified EVs titled and registered in Colorado are eligible for a tax credit. The credit is worth up to 5000 for passenger vehicles and more for trucks.

This will allow Colorado consumers to immediately take advantage of the financial benefit of the current 4000 state tax credit at the point of sale. State andor local incentives may also apply. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle.

2500 to buy or 1500 to lease. Ad Electric Efficiency With The Range Of Gas. As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500.

Electric Vehicle Charging Stations City Of Centennial

Tax Credits De Co Drive Electric Colorado

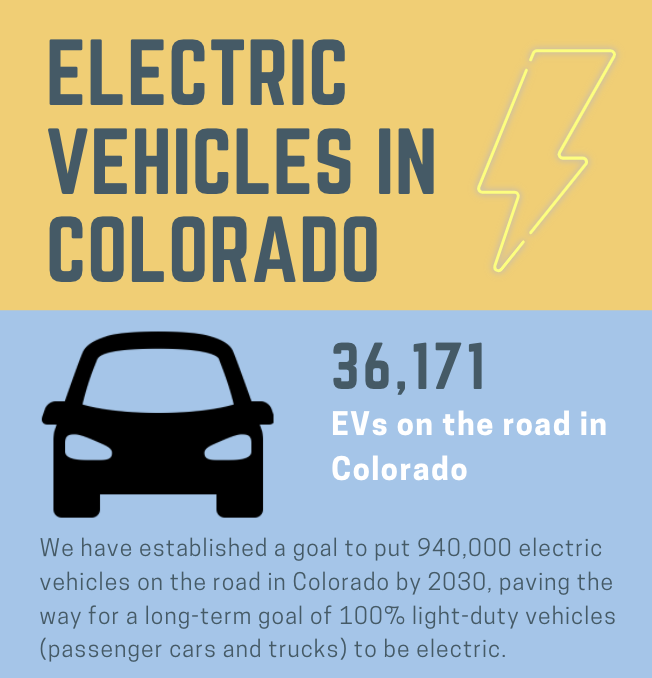

Electric Vehicles In Colorado Report May 2021

Electric Vehicles In Centennial City Of Centennial

Car Charging Company Is On A Tear Buying Ge Stations Securing Investments Ev Charging Battery Powered Car Ev Charging Stations

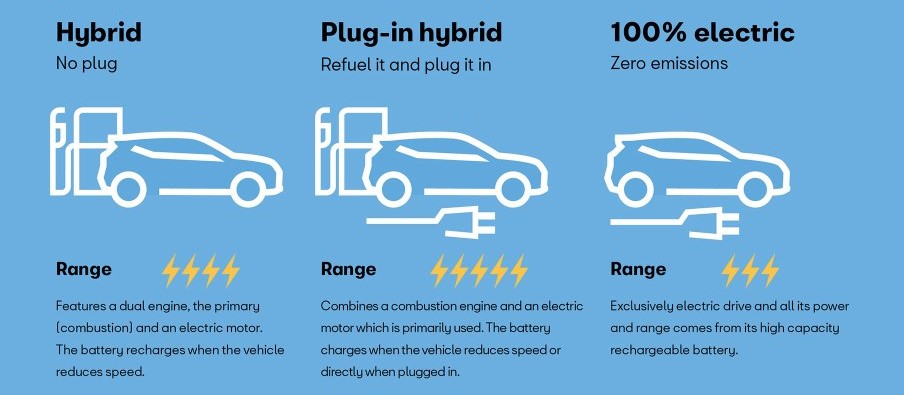

All About Electric Vehicles De Co Drive Electric Colorado

Overview Electric Vehicles Tax Benefits Purchase Incentives In The European Union 2021 Acea European Automobile Manufacturers Association

How Do Electric Car Tax Credits Work Credit Karma

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Electric Vehicle License Plate Bill Passes

States Used To Help People Buy Electric Cars Now They Punish Them For It Electric Cars Hybrid Car Electric Car Conversion

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Tax Credits Drive Electric Northern Colorado

Zero Emission Vehicle Tax Credits Colorado Energy Office

Tax Credits De Co Drive Electric Colorado

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Get A New Nissan Leaf As Low As 11 510 After Incentives In Kansas Or Missouri Nissan Leaf Nissan Best Hybrid Cars